In 2025, Revolut continues to redefine the digital banking experience, offering a comprehensive suite of financial services that cater to the diverse needs of its global user base. With over 45 million customers worldwide, Revolut has solidified its position as a leading fintech company, providing innovative solutions that challenge traditional banking paradigms.

Core Features and Benefits

$40 Welcome Bonus

New users can take advantage of a generous $40 welcome bonus by following these steps:

- Sign Up: Create a new Revolut account.

- Complete Identity Verification: Ensure your account is fully verified.

- Add Funds: Deposit a minimum amount into your account.

- Order Physical Card: Request a physical Revolut card.

- Make Three Purchases: Complete three transactions, each with a minimum value.

This offer provides an excellent introduction to Revolut’s services, allowing new users to explore the platform’s capabilities with added value.

Smart Money Management

Revolut offers a suite of tools designed to enhance financial management:

- Detailed Analytics: Gain insights into spending patterns with comprehensive monthly reports.

- Custom Budgeting: Set personalized budgets to monitor and control expenses effectively.

- Automated Savings: Utilize features that automatically set aside funds for future goals.

- Round-Up Transactions: Opt to round up purchases to the nearest dollar, with the difference saved or invested.

Global Travel Benefits

For frequent travelers, Revolut provides:

- Zero-Fee International Spending: Use your card abroad without incurring foreign transaction fees.

- Competitive Exchange Rates: Access favorable rates for currency conversions.

- Travel Insurance: Benefit from comprehensive coverage options tailored for travelers.

- Hotel Booking Cashback: Receive up to 10% cashback on hotel bookings made through the app.

New Features in 2025

Revolut X Trading Platform

Revolut X introduces advanced trading capabilities:

- Zero Maker Fees: Engage in trading without additional costs.

- Professional Tools: Access sophisticated trading instruments and analytics.

- TradingView Integration: Utilize integrated charts and technical analysis features.

- Real-Time Market Analysis: Stay informed with up-to-the-minute market data.

Expansion into India

Revolut’s strategic expansion into India includes:

- Multi-Currency Accounts: Manage multiple currencies within a single account.

- International Remittance Services: Facilitate seamless cross-border money transfers.

- Premium Card Offerings: Access exclusive card options with enhanced benefits.

- Localized Features: Experience services tailored to the Indian market.

Security and Protection

Revolut prioritizes user security through:

- Cold Storage for Cryptocurrencies: Safeguard digital assets with secure offline storage.

- Multi-Factor Authentication: Enhance account protection with additional verification steps.

- Biometric Security: Utilize facial recognition and fingerprint scanning for secure access.

- Real-Time Fraud Detection: Receive instant alerts for suspicious activities.

Account Options

Revolut offers various account tiers to suit different needs:

- Standard Account (Free): Includes basic currency exchange, free European IBAN, virtual cards, and basic budgeting tools.

- Premium Plans: Provide metal card options, higher ATM withdrawal limits, exclusive perks, and advanced analytics.

Business Solutions

Revolut extends its services to businesses with:

- Multi-Currency Management: Handle transactions in various currencies effortlessly.

- Employee Expense Cards: Issue cards for employees with customizable spending limits.

- API Integration: Seamlessly connect with existing business systems.

- International Payments: Execute cross-border transactions with ease.

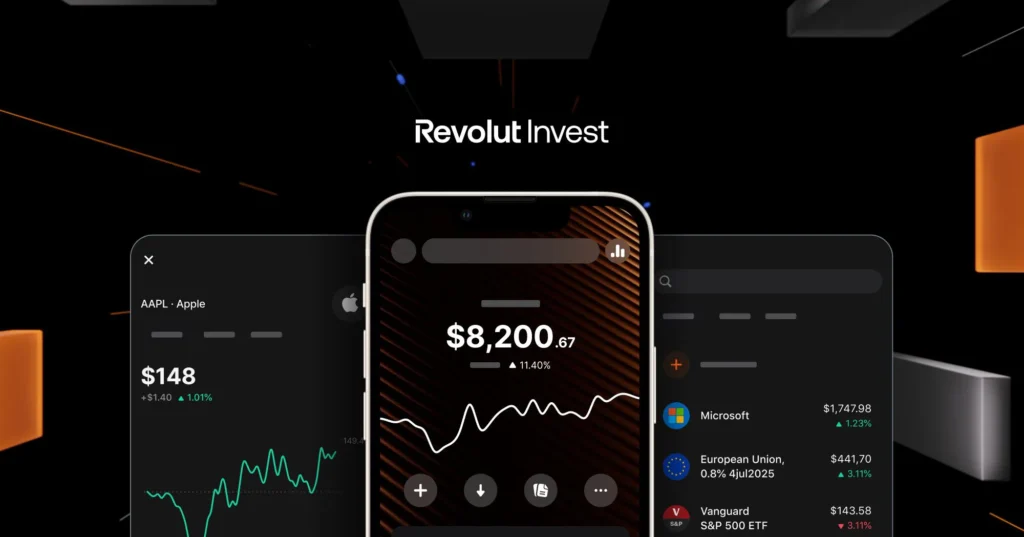

Investment Opportunities

Revolut provides diverse investment options:

- Cryptocurrency: Access over 200 cryptocurrencies with secure storage and instant exchanges.

- Traditional Investments: Trade stocks, commodities, ETFs, and precious metals.

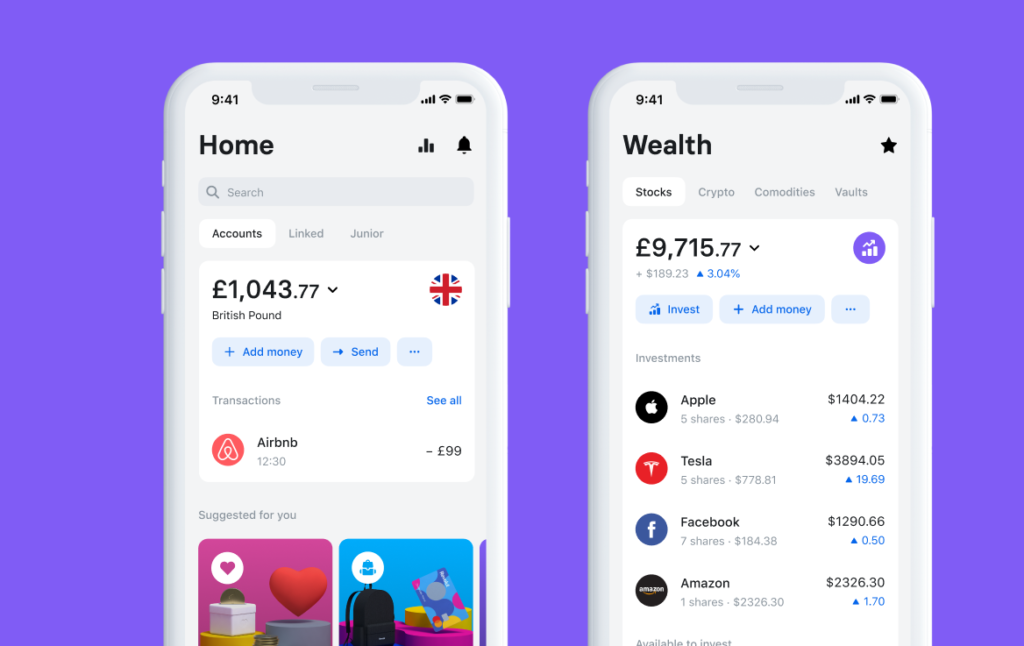

Mobile App Experience

The Revolut app delivers:

- Intuitive Interface: Navigate with ease through a user-friendly design.

- Quick Payment Processing: Experience swift and secure transactions.

- Real-Time Notifications: Stay updated with instant alerts on account activities.

- Smart Features Integration: Benefit from AI-driven insights and personalized financial advice.

Revolut offers comprehensive support through:

- 24/7 In-App Chat: Access assistance at any time directly within the app.

- Priority Support for Premium Users: Receive expedited service for premium account holders.

- Comprehensive Help Center: Find answers to common questions and guides.

- Community Forums: Engage with other users and share experiences.

Pros and Cons

Advantages

- Seamless International Transactions: Conduct global transactions effortlessly.

- Competitive Exchange Rates: Benefit from favorable rates for currency conversions.

- Comprehensive Investment Options: Access a wide range of investment opportunities.

- Advanced Budgeting Tools: Utilize sophisticated tools for effective financial management.

Limitations

- Cash Deposit Restrictions: Limited options for depositing cash into the account.

- Premium Features: Some advanced features require a premium subscription.

- No Physical Branches: Operates entirely online without physical locations.

- Geographic Restrictions: Availability of services may vary by region.

Final Verdict

Revolut has solidified its position as a leading digital banking solution by continually evolving and expanding its services. The introduction of AI-powered assistance, mortgage services, and physical ATMs demonstrates a commitment to meeting the diverse needs of its user base. While there are some limitations, such as cash deposit restrictions and geographic constraints, the overall value proposition remains strong. For individuals seeking a comprehensive, user-friendly, and innovative financial platform, Revolut stands out as a compelling choice.